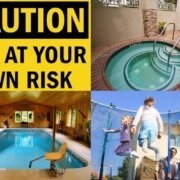

We’ve all seen them in everyday life; ‘Park here at your own risk’, ‘Playing in this area is at your own risk’. Disclaimer notices have become an increasingly common sight for most of us. Therefore it may surprise you to find that they don’t absolve the owner from blame should something go wrong. This is equally true for your holiday home and the facilities that you provide for your guests.

We’ve all seen them in everyday life; ‘Park here at your own risk’, ‘Playing in this area is at your own risk’. Disclaimer notices have become an increasingly common sight for most of us. Therefore it may surprise you to find that they don’t absolve the owner from blame should something go wrong. This is equally true for your holiday home and the facilities that you provide for your guests.

Do you have one of these signs at your holiday let? Have you mentioned this sort of wording within your welcome pack? Let’s take a look at:

- how far these go in removing or reducing your liability, and

- what you should be doing to make sure that you’re fully covered should the worst happen.

The legal bit – is your disclaimer notice valid?

As part of the unfair terms provisions in the Consumer Rights Act 2015 it is stated that no contract term, or notice, can legally have the effect of excluding or restricting liability for death or injury caused by negligence in the course of business.

What does this mean if an accident occurs as a result of your negligence? Your disclaimer wording won’t get you off the hook in terms of blame.

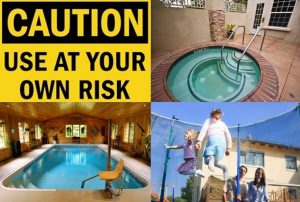

What exactly does negligence mean in this context? An example may be if someone were to hurt themselves whilst playing on your trampoline. There is of course the risk of an accident happening when bouncing on any trampoline. However should the accident happen for instance because the trampoline collapsed and you hadn’t carried out any recent checks on the equipment. Your disclaimer notice will most definitely not absolve you from any liability.

When could they be valid?

If your notice clearly only applies where someone else, or a factor outside anyone’s control, is to blame, then it can be valid. An example here might be if someone were to swim in an area of the sea that is well known for having a strong rip tide. However, if thinking about your holiday cottage, the majority of elements you will have some sort of control over reducing risk, whether that’s your hot tub, children’s play equipment or a trampoline.

What should you be doing?

Regardless of whether you have a sign on display or not, your responsibility to your guests as a holiday homeowner means that it’s vital to have procedures in place. Ensure that everything your guests are using is regularly inspected and abiding by manufacturer’s and legislative guidelines.

Making sure that you work to processes and guidelines will not only mean that the chances of an accident occurring are reduced, but also ensure that you’re not seen as negligent should it still happen.

The insurance bit

Bosher’s Holiday Home Insurance policies come with £10,000,000 of Public Liability cover as standard. In the event of an accident any insurer will want to know about the steps taken to reduce the potential risk. Keeping a written record of risk assessments, inspections, maintenance and guidance for the use of your facilities is highly recommended. You’ll find more guidance on this below.

Please note this article is only an initial guide to the legal validity of disclaimer notices. For further information about your liability as a holiday let owner please seek legal advice. Alternatively give us a call if it’s an insurance matter.

Boshers offer specialist holiday home insurance to owners across the UK. For more information on how Boshers can help and support you as a holiday cottage owner, please give us a call. Alternatively for further information on holiday home insurance visit the website page most relevant to you: