Accidents happen, and whilst health and safety measures will reduce potential risks there may still be a time when a guest is injured at your holiday home. Our holiday home insurance policy comes with public liability as standard, but there are some steps you’ll need to carry out should an accident occur.

Accidents happen, and whilst health and safety measures will reduce potential risks there may still be a time when a guest is injured at your holiday home. Our holiday home insurance policy comes with public liability as standard, but there are some steps you’ll need to carry out should an accident occur.

Make sure communication is at the forefront of your mind

First and foremost, make sure that as soon as you’re made aware that a guest has been injured, you check on their condition. Identify how serious the incident was, and also exactly where, how and when it took place. Having firm and hard facts will be important when dealing with your insurance provider.

Don’t admit liability

It can be a very English thing to say sorry as soon as someone has been hurt. However, sometimes accidents happen, so until it is completely apparent that the incident has taken place as a result of your actions, don’t steam in and admit any liability.

If someone has been injured discussions in the immediate aftermath can become heated. Think of the best way to deal with the situation. Whether that would be through a face to face meeting or asking them to provide a written account of what has happened (often a good way for them to let off some steam). Do not respond to any correspondence beyond acknowledging receipt and stating that you have passed it on to your insurers. It is imperative that you forward correspondence to your insurers as soon as you receive it.

Inform your insurance company

Next, you will need to inform your insurance provider. We recommend you do this as soon as possible for the benefit of you and your guest. Provide them with full details of what happened (which is why it’s vitally important you gather this information), as well as information on any injuries sustained. The more information you let your insurance provider have the better. If it’s received as quickly as possible they’ll be able to deal with your claim and resolve it. Afterall, this is ultimately what you and the injured party will both want.

Begin gathering information

Once your insurer has been informed, you may need to gather evidence which proves your holiday let is well run. Paying particular attention to how you manage it in accordance with health and safety regulations. This evidence could include maintenance schedules, proof of adherence with legislation, updated risk assessments. Gather these, together with anything else that may be relevant. By displaying that your property and grounds are safe and well maintained will demonstrate that you’ve taken reasonable precautions. Don’t be alarmed if the insurance company appoint an independent adjuster to take photos and discuss the claim with you. They are just gathering the facts, so always be open and honest with them. They’ll take the matter forward with the intention of concluding the claim on the best terms.

Forward all communication to your insurance provider

Finally, ensure that any correspondence from the injured party (or their representative) is dealt with promptly. Where possible forward it to your broker or insurance company by return of post or immediately if by email. Any delay could prejudice your position.

Whilst reading this article you’ve probably been asking yourself if you have taken all possible measures to protect visitors to your holiday home. We have many other articles on these subjects, here are links to a few which may be of interest to you:

- `At your own risk’ | How valid are disclaimer notices?

- Holiday home facilities | 6 steps to improve guest safety

- Holiday letting guest safety – understanding your obligations

- How to comply with the fire safety law for holiday letting

Boshers offer specialist holiday home insurance to owners across the UK. For more information on how a specialist insurer can help and support your holiday home business, please give us a call. Alternatively for further information on holiday home insurance visit the website page most relevant to you:

- Click here if you require holiday let insurance for your annexe

- Cick here if you own a single furnished holiday letting home, cottage or apartment

- Click here if you own a listed holiday home or cottage complex

- Click here if you own a holiday cottage complex

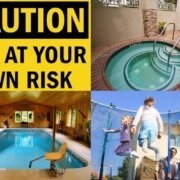

We’ve all seen them in everyday life; ‘Park here at your own risk’, ‘Playing in this area is at your own risk’. Disclaimer notices have become an increasingly common sight for most of us. Therefore it may surprise you to find that they don’t absolve the owner from blame should something go wrong. This is equally true for your

We’ve all seen them in everyday life; ‘Park here at your own risk’, ‘Playing in this area is at your own risk’. Disclaimer notices have become an increasingly common sight for most of us. Therefore it may surprise you to find that they don’t absolve the owner from blame should something go wrong. This is equally true for your

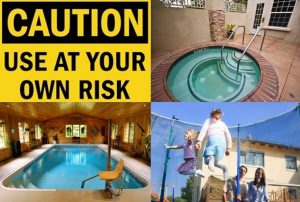

When adding additional facilites to your holiday home consideration should be given to guest safety and holiday homeowner liability risks. Tourism is an increasingly competitive marketplace; what makes someone choose your

When adding additional facilites to your holiday home consideration should be given to guest safety and holiday homeowner liability risks. Tourism is an increasingly competitive marketplace; what makes someone choose your