Tourism Accommodation and the Law – A One Day Conference on Legislation Affecting Tourism Accommodation Businesses including self-catering holiday homes, cottages and apartments run as furnished holiday letting properties.

Tourism Accommodation and the Law – A One Day Conference on Legislation Affecting Tourism Accommodation Businesses including self-catering holiday homes, cottages and apartments run as furnished holiday letting properties.

VisitEngland hosted the above conference in London on the 12th February 2013 to update attendees on recent and forthcoming legislation changes that affect tourism accommodation in England and no doubt also of interest to owners and operators across the rest of the UK. The conference was aimed at accommodation assessors, including National Quality Assessment Scheme franchises and local schemes, self-catering agents, destination managers, TIC managers, trade associations, tourism consultants and suppliers such as ourselves as specialist holiday home insurance advisers to the UK holiday letting market.

The day was split into two main sessions covering aspects of Tourism Accommodation and the Law, the morning one concerned with Rules and Regulations and the afternoon with Legal Duties and Responsibilities.

Rules and Regulations – in particular the topics covered included:

- Trading Standards – including Consumer Protection from Unfair trading Regulations, Cancellation Policies, Terms and Conditions etc

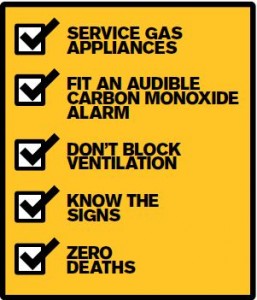

- Fire Safety Regulations – in particular the requirement for both a fire safety risk assessment and a fire safety policy for your guest accommodation

- The Planning System – an interesting insight into a private and public sector inititive to improve the fortunes of Great Yarmouth

- Music Copyright – clarification of Performing Right Society (PRS) licence requirements and reference also to the PPL and their licence requirements

Legal Duties and Responsibilities – topics covered included:

- Discrimination, Equality and Human Rights – including an interesting presention on guests with Assistance Dogs

- Terms and Conditions – highlighting the importance of writing your terms and conditions in plain english and avoiding legalese

- The Digital Business – Wi-Fi data protection and the online environment including a snippett of information on the forthcoming Digital Economy Act and Defermation Bill

The day provided a great insight into the Laws affecting tourism accommodation. Look out for a series of blog posts of interest to holiday home owners over the coming weeks which will expand on some of the above areas, there effect on furnished holiday letting owners together with some solutions to challenges faced by you whilst managing your holiday home, holiday cottage complex or holiday apartments.

For further information on UK holiday home insurance visit the website page most relevant to you: